Our Vision

Build a large, respected institutional long-term mortgage-led retail lending company that caters to the unique requirements of self-employed Indians, who are typically credit underserved.

We will continue to expand our franchise by focusing on the large, underserved affordable housing finance opportunity and its adjacencies in India, thereby creating a lasting positive impact in the communities we serve.

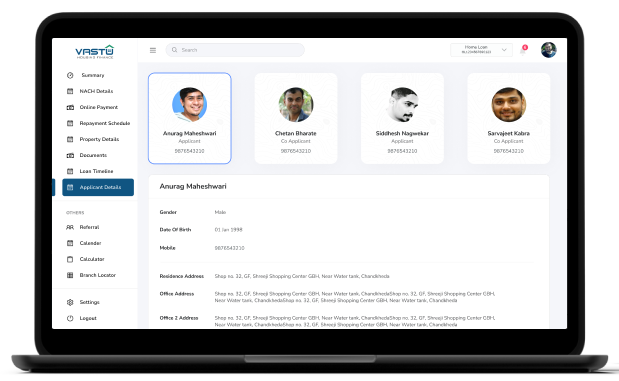

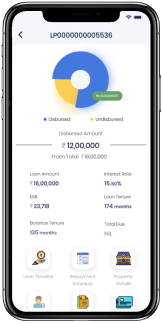

As trusted partners on the path to homeownership, we offer unwavering support and guidance at every step, ensuring our customers’ success. Cutting-edge technology, automated processes, and predictive analytics drive our operational excellence, cost efficiency, and diligent risk management at scale.

We foster a culture of collaboration, inclusion, and empowerment, attracting and retaining top talent committed to our mission.

Financial sustainability is paramount in our pursuit of this vision. We prioritise maintaining a strong financial foundation and delivering consistent long-term returns to our capital providers.

We adhere to regulatory standards, promote fair lending practices, and champion transparency and accountability. By upholding the highest standards of integrity, we earn the trust and confidence of our customers, partners, and other stakeholders.